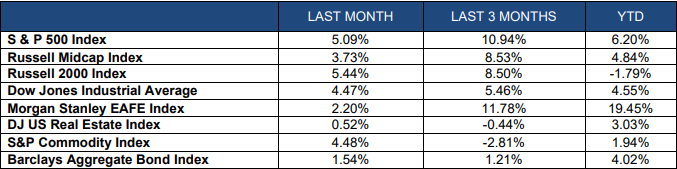

INDEX RETURNS

Diversification is back! After years of dominance by U.S. Large cap stocks, 2025 has once again shown that other asset classes can provide growth in uncertain times. The S&P 500 had a great quarter advancing nearly 11% and is now up 6.2% on the year. The Russell Midcap Index also had a solid quarter and is now up almost 5% on the year. The Russell 2000 Index has recovered nearly all its early losses and is now only down 1.79% on the year. Gold and Silver have continued a strong surge so far this year and have helped the commodity index post a gain of 1.94%.

International stocks are stealing the spotlight with strong local performances enhanced by a weakening dollar. The MSCI EAFE Index gained 11.78% in the quarter and is now up more than 19% on the year. Emerging Markets also offered diversification benefits with a gain of 11.99% in the quarter. Brazil, Chile, South Korea, and Mexico powered this index to a return of more than 15% on the year.

Bonds continued to offer solid returns in the quarter and are now up 4.02% on the year. Global bonds rose almost 2.5%, and are now up an impressive 5.6% in the first half of the year.

ECONOMIC REVIEW AND OUTLOOK

Despite significant concerns about tariffs and the economy, economic activity has remained resilient. First quarter GDP was adjusted down to an annual rate of -0.5%. It is important to understand that imports detracted more than 4 percentage points from this number. Otherwise, consumer spending was solid in the first three months. The first quarter decline was due to businesses increasing their imports ahead of the potential tariffs. Since this headwind has subsided, economic activity has rebounded in the second quarter. Expectations are that the second quarter GDP number will be in the 3 – 4.5% range, which is a significant rebound from the first three months.

The Senate and the House of Representatives passed the new bill a few days ago. There is a lot to digest in this bill, but let’s take a high-level view for a moment. Most of the soon to expire tax cuts from 2017 have been extended. In addition, there are new tax breaks for Social Security benefits, tips, overtime work and auto loans. These breaks are retroactive to the beginning of 2025. Since most payroll companies will not make a change in withholdings right away, look for many taxpayers to have larger refunds in the first quarter of 2026. So, while we could see short-term economic softness in the second half of this year, look for a strong start to 2026.

The Federal Reserve seems to be very content with rates at these levels. Inflation is hovering around 2.4% annually, which is close to the Fed’s target of 2.0%. The market still expects two rate cuts in 2025. Since the labor market is solid, most of this will rest on the inflation data.

The Leading Economic Index decreased by 0.1% in May to 99.0 following a 1.4% decline in April. Industrial Production decreased 0.2% in May. The Capacity Utilization Rate (which measures how much slack is in the economy) moved down to 77.4%.

Non-farm payrolls rose by 146,000 in June and the unemployment rate dropped to 4.1%. Weekly unemployment claims were 233,000 for the week ending June 28, 2025. The 4-week moving average is at 241,500. There are 7.2 million job openings in the U.S. It is important to remember that the unemployment rate is a lagging indicator. Although a weaker economy typically triggers a higher unemployment rate, the massive drop in immigration may keep the labor force thin causing the rate to hold steady.

Manufacturing registered 49.0% on the ISM PMI Index in June. This indicator remains in contraction territory. The New Orders Index came in at 46.4% which marks the fifth month in a row of contraction. The ISM Services Index was at 50.8% in June, which was up 0.9% from the prior month. The Business Activity Index came in at 54.2% which was higher than the 50.0% reading in May. New Orders for the service sector came in at 51.3% which is now in expansion territory.

The JPM Global Manufacturing PMI was at 51.7 in June. The Euro area is at 50.2 while Emerging Economies are growing at 50.9 led by India and Brazil.

EQUITY AND BOND MARKETS

The second quarter saw solid gains across most asset classes. It was a perfect lesson in staying invested and not trying to time the market. News at the end of the first quarter was confusing with the uncertainty of the tariffs. Once the market had clarity, both domestic and international stocks, pushed higher.

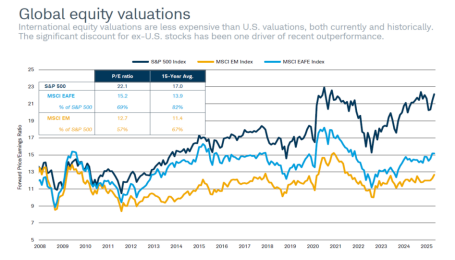

Diversification works over the long-term if you look at historical data going back to the 1950s. However, since 2009, the S&P 500 has dominated most other asset classes both domestically and abroad. So far this year, being diversified is paying significant dividends. International equities have been under appreciated for a while. With low valuations and a falling dollar, their performance in 2025 has been stellar. The S&P 500 is still carrying a fairly high P/E ratio, so international stocks are much cheaper. We think international equities could continue to provide portfolios with return enhancements over the next 5-10 years. It will be important for all investors to make sure they are diversified both domestically and globally.

The bond market has produced solid returns for investors in 2025. The Barclays Aggregate Bond index is up 4.02% in the first half of the year. Global bonds are up 5.6% in the first six months. While cash is an acceptable short-term place holder, over the long-term bonds typically outperform cash and is a better investment.

One of the major themes so far this year has been the performance of alternative asset classes. Commodities such as gold and silver have been on an impressive run. Gold is currently up more than 26%. In addition, Bitcoin is up more than 21% on the year. Having a small allocation to non-correlated asset classes can offer enhanced returns and downside protection. Just another reason to make sure your portfolio is diversified.

PORTFOLIO MANAGEMENT

The Investment Committee continues to monitor the economy, the market, and the portfolio allocations. The economy picked up major steam in the second quarter as imports slowed and consumer spending remained decent. The second quarter GDP number should be impressive after a minor contraction in Q1.

Although the labor market and housing market are showing some weakness, we think there are enough positives to keep this economy out of a recession in 2025. If that happens, we can look forward to a decent 2026. As mentioned previously, the bill that was passed in Washington is retroactive to the beginning of 2025. Some households will see their tax liability decrease when they file their tax returns in the first quarter of next year. Households tend to spend these refunds, which could be a boost to the economy. For other taxpayers, even if they do not see a decrease in their liability, they have clarity that their taxes will not increase in 2026.

We do expect volatility to continue over the next six months. Maintaining an appropriate allocation and diversification will be critical to long-term performance. While nobody can predict what can happen in the shortterm, we believe that long-term investors will be rewarded with good returns if they can just keep a long-term focus and ignore any of the short-term volatility.

FINANCIAL PLANNING

Over the past several years, more and more individuals and families have been finding themselves covered by high-deductible health insurance plans. High-deductible insurance plans are popular as they typically offer a lower monthly premium than their more traditional counterparts. However, when a claim is submitted, the individual or family is responsible for the full cost of that claim until their annual deductible is met. To be considered a true highdeductible insurance plan, the annual deductible must be over $1,650 for individuals and $3,300 for families. Even if a plan is not considered high-deductible, out-of-pocket costs for all types of medical insurance plans have been increasing.

There are several tax-advantaged vehicles to help with rising out-of-pocket costs. Health Savings Accounts (HSA) are the most common account type. However, certain individuals with employer sponsored plans could be eligible for Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs).

Health Savings Accounts (HSA) can be opened by anyone who has a high-deductible plan. They do not need to be sponsored by an employer. HSAs have what is referred to as a triple tax advantage: contributions made to an HSA are tax-deductible, earnings within the account are tax-deferred, and withdrawals are tax-free if used for qualified medical expenses. 2025’s maximum contribution limit is $4,300 for individuals and $8,550 for families. Individuals over age 55 can contribute an additional $1,000. Both an employer and an employee can contribute funds into an HSA. HSA funds can be invested. Funds can be rolled over from year to year. There is no time limit on withdrawing funds.

Flexible Spending Accounts (FSAs) must be opened through an employer. The maximum contribution this year is $3,300. FSAs have a “use-it or lose-it” caveat. All funds contributed for that year must be withdrawn that year or the funds are forfeited. Typically, individuals cannot open an HSA and an FSA for health care at the same time.

Health Reimbursement Arrangements (HRAs) are owned by an employer on behalf of an employee. All contributions come from the employer; employees are not eligible to invest their own money. HRAs can still be used for qualified medical expenses, but individuals and families must ask for reimbursement from the employer sponsored plan. Typically, HRAs funds do not transfer with an employee if they separate from service prior to formal retirement. However, HRAs can be specific to the employer who sponsors the plan.

COMPANY NEWS

This year, Melanie Colwell is celebrating 20 years with Galecki Financial Management. As she likes to remind us, yes… she did start working at the firm at age 10.

This year, Melanie Colwell is celebrating 20 years with Galecki Financial Management. As she likes to remind us, yes… she did start working at the firm at age 10.

Melanie started at our firm in an entry-level position as a Paraplanner (now called a Staff Financial Planner). Melanie initially worked with Greg Galecki, assisting with his client relationships. She assisted with retirement projections, estate planning presentations, risk management analyses, and handled all other financial planning items for clients.

Shortly after joining, Melanie began studying for her CERTIFIED FINANCIAL PLANNER® certification. She completed the self-study program through Kaplan, usually studying in the early morning hours before her three young children woke up for the day. In 2007, Melanie became a CFP® professional.

In 2010, Melanie became a Shareholder of our firm. Along with being an incredible Senior Financial Planner, resource, and friend to her clients, we also credit Melanie with helping to create a strong company culture for our firm. Melanie has always advocated for our employees to have the resources they need to balance (as best as any of us can!) our personal and professional lives.

Melanie has attended several conferences and seminars geared towards addressing the unique needs of clients who are experiencing grief. She has implemented a grief training program for the Galecki team and is available to speak to support groups about the unique financial planning issues facing widows. Melanie also earned her Certified Divorce Financial Analyst® designation through the IDFA in 2015 and is currently the only woman in our area to hold the CFP® designation and the CDFA® designation.

Melanie offers a service called the Divorce Financial Overview (DFO) for clients navigating the dissolution of a marriage. The purpose of the DFO is to provide the Client with a review of their financial situation based on a proposed divorce settlement. The DFOs will focus on a cash flow analysis based on a proposed divorce settlement and typically includes alternate asset distribution scenarios. The DFO includes a customizable Divorce Distribution Worksheet, reports outlining the projections, and a letter discussing the assumptions, results, and recommendations. The fee for the DFO is $500.

It is safe to say our firm would look a lot differently if Melanie had never joined us 20 years ago. We are thankful for her leadership, compassion, and experience. Cheers to 20 more!

If you would like to schedule an appointment with a CERTIFIED FINANCIAL PLANNER® Professional, please visit www.galecki.com.