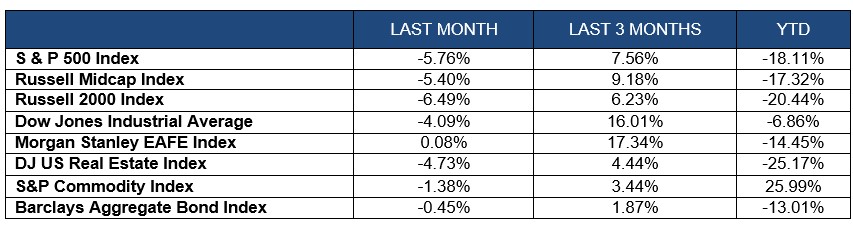

Index Returns

Prior to 2022, there have only been two years (1931 and 1969) in which stocks and bonds were both down in the same year. To say this occurrence is uncommon would be a big understatement. In fact, there were zero years in which both were down more than 10% in the same year! This is why investors felt like there was nowhere to hide last year. The S&P 500 declined more than 18%, while Mid-Cap stocks and Small-Cap stocks dropped 17% and 20% respectively.

International stocks outperformed in the final quarter and December. The EAFE Index dropped 14.45% on the year after a positive 17% in the final three months. Emerging markets ended the year down 20% but did jump 9.7% in the final quarter. Brazil and Chile were positive on the year with returns of 14% and 26% respectively.

Bonds had a brutal year with the Barclays Aggregate Bond index declining 13.01%. Global bonds finished the year down 18.37% but did see a jump of 8.4% over the last three months.

Economic Review and Outlook

The Federal Reserve continues to battle inflation by raising short-term interest rates. The current Fed Funds target is 4.25% – 4.5%. Expectations are that they will get to 5.00% – 5.25% and then pause. Headline inflation dropped in December by 0.1% and is now only up 6.5% from a year ago after peaking at 9.0% in June. There is no doubt that inflation is cooling, and the economy is slowing.

Gross Domestic Product is the broadest measure of our economic output. In 2022, we had negative output in the first two quarters followed by a 3.2% annualized growth rate in the third. Expectations are that the fourth quarter GDP number will be in the 2.0-2.5% range. The housing market has slowed down dramatically, but the labor market is still tight. Expectations are that the economy will be in a recession at some point in 2023. It is important to remember that an average recession does not last that long, and the market is a leading economic indicator not a coincident indicator.

The Leading Economic Index declined 1.0% in November to 113.5 following a 0.9% decline in October. Industrial Production declined 0.2% in November. The Capacity Utilization rate (which measures how much slack is in the economy) was down 0.2% in November which is 0.1% higher than the long-term average. The production of business equipment dropped by 0.8% as demand is slowing.

Non-farm payrolls rose by 223,000 in December and the unemployment rate fell to 3.5%. Notable job gains occurred in leisure and hospitality. Weekly unemployment claims were 205,000 for the week ending January 7, 2023. This was a decrease of 1,000 from the previous week and the 4-week moving average is at 212,500.

Manufacturing decreased to 48.4% on the ISM PMI index in December. This was a drop of 0.6% from November. This index is now in contraction for the first time in 30 months. The New Orders Index came in at 45.2% which was down 2% from the prior month. The ISM Services index was at 49.6% in December. This was 6.9% lower than November and marks the first contraction since May of 2020. The Business Activity Index came in at 54.7 which was a 10% drop! New Orders for the service sector came in at 45.2%. This was a drop of 10.8 percentage points and marks it’s first contraction since May of 2020.

The JPM Global Manufacturing PMI was at 47.4 in December and continues to show that global economies have been in contraction since August. China is at 47 but is starting to open back up their economy from their COVID lockdowns. France, Germany, and Italy all came in around 48 on the PMI Index showing contraction as well.

Equity and Bond Markets

What happened in 2022 and where do we go from here? That is the big question as we move into a new calendar year. Bonds declined in 2022 as the Federal Reserve raised rates making existing bonds worth less. Equities declined for many reasons, but primarily due to the impact that inflation has on consumers. Consumer spending is 70% of our economy and discretionary income is constrained when households spend more on gas, groceries, and utilities. Therefore, investors needed to re-price equities for reduced revenue and earnings.

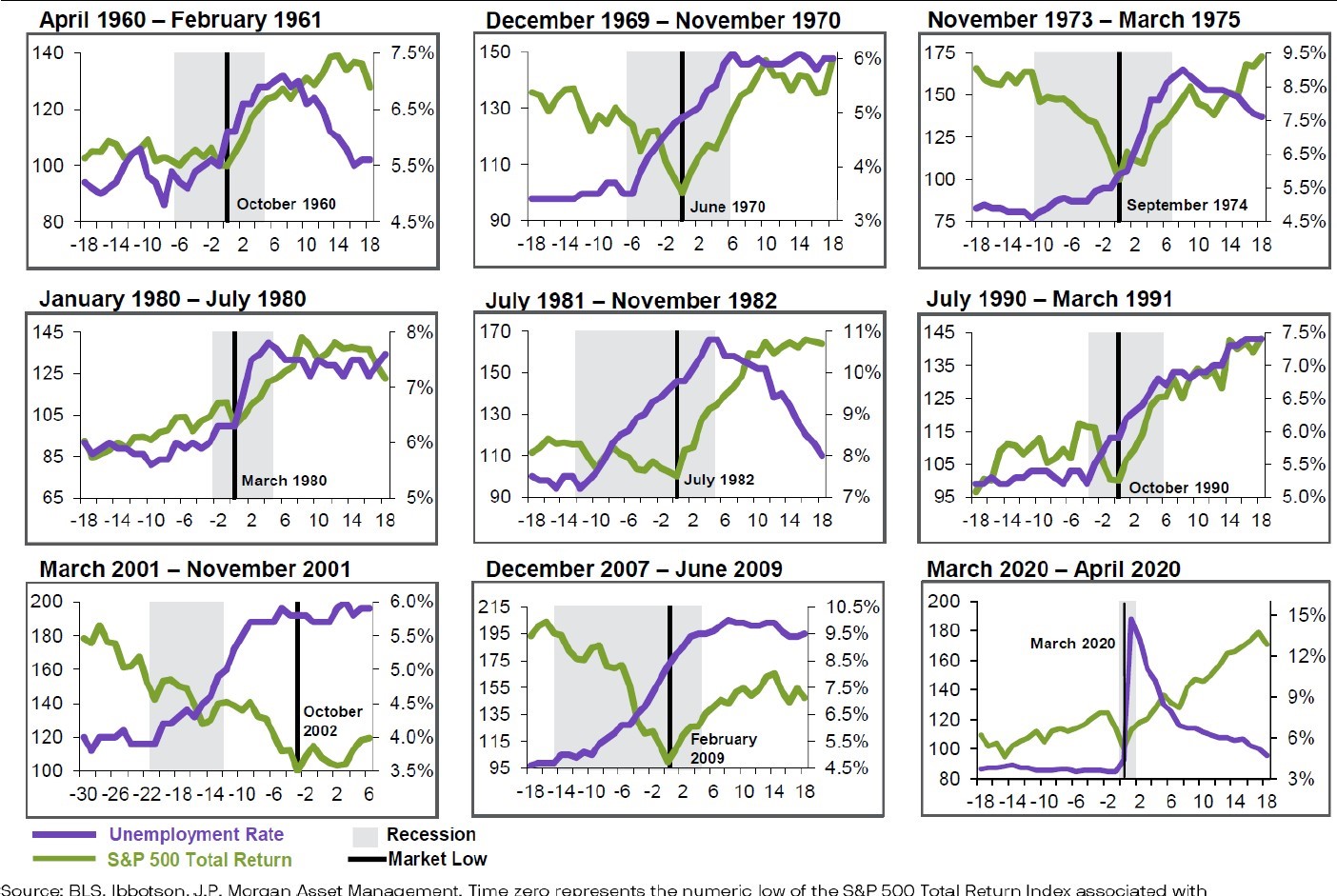

The good news is that the market is a leading economic indicator. It typically tells us what the economy will be doing 5-9 months from now. The chart below shows the last nine recessions going back to 1960. In 8 out of the 9 occurrences, the market began to rise well before the recession was over.

The Ned Davis Research Crowd Sentiment Poll is currently in extreme pessimism territory. Going back to 1995, the S&P 500 has returned 9.87% on average when it is in this zone. The University of Michigan Consumer Sentiment Index hit a 50-year low in June. Historically, when this index hits a low, the next 12 months in the market has averaged 24.9% going back to 1950. While there is no guarantee that the next twelve months will be this robust, it at least gives us some reassurance that stocks typically do well in the long run off these levels. It is impossible to know what will happen in the short-term, but stocks are 20% cheaper than they were a year ago.

The forward P/E ratio for the S&P 500 has dropped down to 16 times earnings, which is right near the 25-year average. If it takes 2 years to return to the January of 2022 high, this will equate to a return of roughly 13% per year on the equity side of the portfolio. If it takes 3 years, that would still be a return of around 9.5% per year.

The forward-looking return projections for a diversified portfolio have improved. Fixed income should contribute to returns over the next few years. Meanwhile, equities continue to offer the best hedge against inflation. After 14 years of domestic equity outperformance, look for international stocks to provide an extra boost.

Portfolio Management

The Investment Committee has continued to stay the course with our asset allocation strategy. Returns last year were in line with expectations and the funds did their job. We continue to believe that international equities should outperform over the next few years as they are much cheaper than domestic stocks. We saw this outperformance begin in the last quarter and it has continued in the first two weeks this year.

We design our portfolios to have an asset allocation strategy that provides optimal diversification and performance. Over a short time horizon, this type of diversified portfolio can decline in value. However, if we keep a long-term perspective and ignore short-term volatility, the probability of achieving our desired returns significantly increases. Remember, “Time in the Market” is more important than “Timing the Market”.

Financial Planning

On December 29th, Congress passed the SECURE Act 2.0 as a part of the wider Consolidated Appropriations Act. The original SECURE Act became law on December 20, 2019. Like it’s predecessor, this new Act changes a variety of provisions across the retirement landscape. There are nearly 100 changes as a part of this Act. Today we are highlighting the top few we believe will impact the most individuals and families. Keep in mind, this law is brand new. There are already some clarifications and possible revisions necessary by the IRS as the law is implemented.

- Required Minimum Distribution (RMD) Age is immediately changed to 73. In 2033, this increases to 75. Anyone born in 1951 to 1959 now has an RMD age of 73. If you planned on starting RMDs this year due to turning age 72, this is no longer a requirement. Your RMD will start in 2024. Anyone born in 1960+ has an RMD age of 75.

- Employers are immediately able to offer their employees Roth matching and Roth non-elective retirement contributions. Profit sharing contributions must remain pre-tax funds. Employers are still able to deduct Roth contributions made to employees’ 401(k)s and 403(b)s. The amount of an employer’s Roth contribution will be included as taxable income to the employee.

- Effective 2024, if an employee’s wages are greater than $145,000, the catch-up 401(k) or 403(b) contribution must be made with Roth dollars. This year if over age 50, you can contribute an additional $7,500 to your 401(k) or 403(b). Currently you can choose to contribute pre-tax dollars or Roth dollars (if allowed by your plan). Beginning in 2024, if income is over the $145,000 threshold, employees must contribute Roth dollars.

- Effective 2025, the catch-up contributions will be increasing for individuals ages 60, 61, 62, and 63, only. The catch-up for those ages will be the greater of $10,000 or the amount equal to 150% of that year’s catch-up contribution.

- Qualified Charitable Distributions (QCDs) will be indexed for inflation beginning in 2024. The current maximum QCD amount is $100,000 per year per taxpayer.

- Effective 2024, a total of $35,000 can be transferred from a 529 plan to Roth IRA for the beneficiary. The 529 plan must have existed for at least 15 years and any contributions/earnings in the last 5 years are not eligible to be transferred. The beneficiary of the 529 and the Roth IRA must be the same person and must have earned income. The amount eligible to be moved into the Roth IRA is subject to the annual contribution limit (currently $6,500). $35,000 is the lifetime maximum that can be moved from a 529 into a Roth IRA for that specific beneficiary.

Bonus: Military Spouse Eligibility Credit. This is an acknowledgement by Congress that the spouses of military members are often required to move regularly thus not able to fully vest in employer sponsored retirement plans. Employers with less than 100 employees can receive a tax credit for allowing participation in the retirement plan after 2 months of employment and immediately vest all employer contributions.

Company News

We work hard to create a welcoming, collaborative, and engaging environment at Galecki. Throughout the year we carve out time for team building events with our staff and their families. We thought it would be fun to highlight a few of our past adventures.