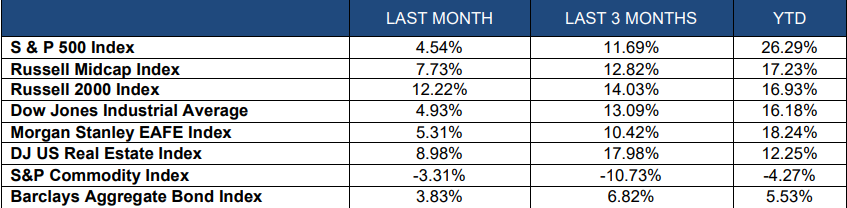

Index Returns

Equities were strong across the board in the fourth quarter. The S&P 500 rallied 11.69% in the final quarter and finished the year up 26.29%. There was a large variance in these returns. The largest ten stocks in the S&P 500 were up 62% while the remaining 490 stocks were only up 8%. Mid-cap stocks and small-cap stocks rallied in the last quarter to finish the year up 17.23% and 16.93% respectively.

Developed International stocks had a very solid year with a return of 18.24% according to the EAFE Index. Italy and Spain were the best performers with returns of 32% and 30% on the year. Emerging markets have been mixed with China declining 11% on the year while Mexico was up 41%. Brazil advanced 33% in 2023. Meanwhile, commodities were down almost 11% in the final quarter to finish the year with a decline of 4.27%.

Bonds rallied in the final quarter with a gain of 6.82% and finished the year up 5.53%. Global bonds also had a good year with a gain of 10.81%.

Economic Review and Outlook

We entered 2023 with a lot of discussion about a recession. It was understandable as the manufacturing sector was in contraction the entire year. In fact, many economists called 2023 “The Cardboard Box Recession”. However, consumer spending makes up nearly 70% of our Gross Domestic Product and consumers kept spending, especially in the service sector. GDP expanded 2.2%, 2.1% and 4.9% in the first three quarters of the year. GDP in the last quarter is expected to be in the 2% range. So, we avoided an official recession in 2023. What will happen in 2024?

It is likely that we see consumer spending drop a bit in 2024 as household debt is creeping higher. However, we don’t expect a major falloff in the data. If we do have a recession in 2024, it is important to remember that they only last about 10 months on average and expansions last roughly 6 years. It is all part of the economic cycle.

The Leading Economic Index declined 0.5% in November to 103 following a 1.0% decline in October. Industrial Production increased 0.2% in November. The Capacity Utilization rate (which measures how much slack is in the economy) moved up to 78.8% which is in line with it’s long-term average.

Non-farm payrolls rose by 216,000 in December and the unemployment rate remained at 3.7%. Weekly unemployment claims were 202,000 for the week ending January 6, 2024. The 4-week moving average is at 207,750. There are 8.7 million job openings in the U.S. which is down from 10.1 million in July. Job layoffs have remained stable while the number of individuals quitting their jobs has dropped. It is important to remember that the unemployment rate is a lagging indicator. It is often very low when we enter recessions and typically peaks 6 months after we exit a recession. Top leading indicators would be the yield curve, durable goods orders, the stock market, manufacturing orders, and building permits.

Manufacturing registered 47.4% on the ISM PMI index in December. While this was an increase of 0.7 percentage points, it still marks 14 straight months of contraction. The New Orders Index came in at 47.1% which was 1.2 percentage points lower from the prior month. The ISM Services index was at 50.6% in December. This was 2.1 percentage points lower than November. This index has now expanded for 12 straight months. The Business Activity Index came in at 56.6% which was a 1.5 percentage point increase from November. New Orders for the service sector came in at 52.8%, but this was a drop of 2.7 percentage points from November.

The JPM Global Manufacturing PMI was at 50.0 in December after being in contraction territory for over a year. The Euro area is at 47.9 while Emerging Economies are growing at 52.0.

Equity and Bond Markets

Equity markets had an odd year in 2023 thanks in part to the development of Artificial Intelligence and its potential impact on profits for certain companies. The Magnificent 7 (Apple, Microsoft, Google, Amazon, Nvidia, Meta, and Tesla) had a monster year with an average return of 62%. They now make up 32% of the market cap weighting for the S&P 500 and are carrying a P/E ratio of more than 27 times forward earnings. If these 7 companies were an official sector, they would be the largest sector in the S&P 500.

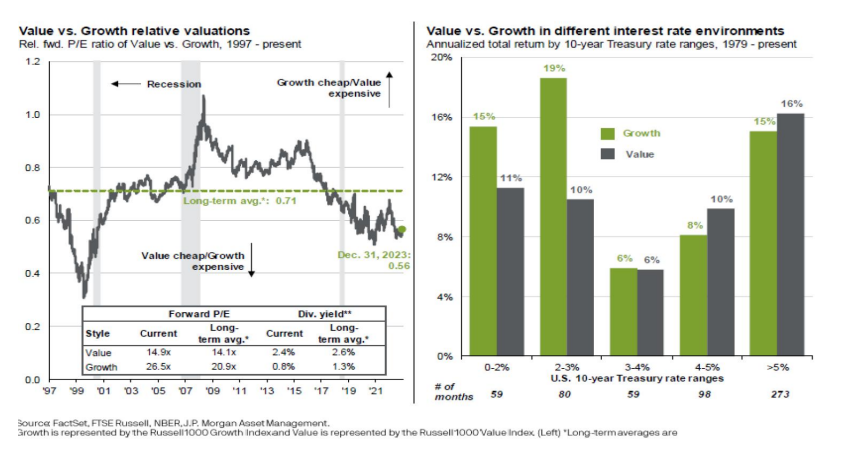

What will happen in 2024 for the equity markets? Well, nobody knows for sure, but we think a repeat of 2023 is unlikely. The strong move higher by the Mag 7 stocks has made large-cap market weighted indexes look less attractive. In fact, while growth stocks tend to outperform in periods of low interest rates, value stocks tend to fare better when interest rates are higher as they are today. Value stocks are offering dividend yields of nearly 3% and are trading at valuations that have not been this low since early 2000. With P/E ratios under 15, we think value stocks and equal weighted indexes could do relatively well in 2024.

This is an election year. Going back to 1928, we have had 23 election years’ worth of data. The market was positive in 19 of 23 years, which is 83% of the time. The average return for the S&P 500 was 11.2%. The average return in years when a Republican was elected President was 15.3% while the average return when a Democrat was elected president was 7.6%. Politicians want to get re-elected and try to be as accommodative as possible.

The Federal Reserve has indicated that they intend to cut rates a few times this year. The bond market is anticipating these cuts. If they do indeed happen, bonds should continue to do well in 2024.

Portfolio Management

The Investment Committee is looking at risk management for 2024. We had some positions that did extremely well last year, and our returns were strong. We do think there are opportunities, but simple indexing may not be appropriate given the disjointed valuations. While we are still constructive on equities in the long-term, our short-term strategy is leaning towards taking some profits off the table from the big winners of last year.

Our fixed income allocation did well last year. The Barclays Aggregate Bond index rallied hard in the fourth quarter and our bond funds responded positively. Bonds are offering attractive yields at current levels, and we should see some price appreciation over the next 18 months if rates start to move lower.

We design our portfolios to have an asset allocation strategy that provides optimal diversification and performance. Over a short time-horizon, this type of diversified portfolio can decline in value. However, if we keep a long-term perspective and ignore short-term volatility, the probability of achieving our desired returns significantly increases. Remember, “Time in the Market” is more important than “Timing the Market”.

Financial Planning

A New Year brings a new set of various contribution limits and thresholds to consider across the financial planning landscape.

Retirement Accounts:

- The 401(k)-employee deferral limit is now $23,000. If over age 50, the catch-up contribution is an additional $7,500.

- IRA and Roth IRA contribution limits increased to $7,000. The catch-up contribution is $1,000.

- SIMPLE IRA contribution limits are $16,000 with a $3,500 catch-up contribution.

Social Security:

- Social Security taxes of 6.2% are levied on earned income up to $168,600 in 2024.

- The maximum earnings if claiming Social Security benefits while under Full Retirement Age increased to $22,320. If earned income (wages and/or self-employment income) is over that threshold in 2024, you may lose a portion of your Social Security benefits. There are special rules and different thresholds if 2024 will

be your first year of retirement.

Health and Flexible Spending Accounts:

- Health Savings Account Maximum Contributions:

- Single Coverage: $4,150

- Family Coverage: $8,300

- Additional $1,000 if over age 55.

- Please note you must have a high-deductible health insurance plan to enroll in an HSA.

- Flexible Spending Account (Medical) Maximum Contribution – $3,200

- Dependent Care Flexible Spending Account – $5,000 per household

Estate Planning:

- Annual Gift Exclusion – $18,000 per person.

- Lifetime Gift/Estate Exclusion – $13,610,000 per person.

- A married couple can give $27,220,000 to heirs either during life or at death and not be subject to any estate taxes.

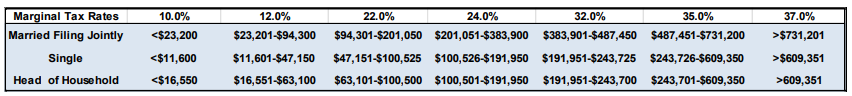

Income Tax Rates:

- The top Federal marginal tax rate remains at 37%. Below are the new income tax brackets for 2024 for taxpayers who file married filing jointly, single, and head of household.

529 Plans

- For all Indiana taxpayers, just a reminder that the maximum state tax credit is now $1,500. To receive the maximum credit, a contribution of $7,500 total can be made into one or across multiple CollegeChoice

sponsored 529 plans. - For any out-of-state taxpayers, it is prudent to check your State’s 529 tax benefits annually as laws may

change.

Company News

We hope that everyone had a happy and healthy holiday season. Our corporate holiday season always involves a team building activity to give back to our local community. This year, we adopted three families through the Allen County Christmas Bureau.

We split into teams to shop for gifts for our families, then spent a morning together wrapping all the presents. Year after year, this is one of our favorite memories as a team.

Wishing you peace, love, and joy in 2024 and beyond!