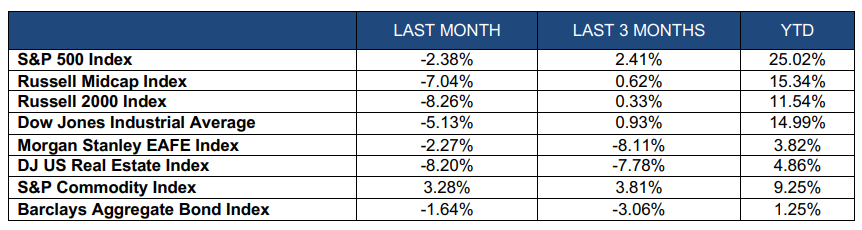

Index Returns

The fourth quarter experienced declines in most asset classes except for large-cap stocks. The S&P 500 saw an increase of 2.41% powered by growth stocks which rose more than 6%. The Russell Midcap Index dropped 7% in December to finish the quarter nearly flat. The Russell 2000 Index declined 8% in December and finished the year up 11%. Commodities rallied in December and finished the quarter with a gain of 3.81%.

Developed International stocks struggled in the last quarter primarily due to a surge in the Dollar. The MSCI EAFE Index declined 8% in the quarter to finish the year with a gain of 3.81%. Emerging markets also dropped 8% in the quarter but finished the year up more than 7%. Real Estate pulled back about 8% in the final three months and finished 2025 with a gain of 4.86%.

Bonds declined in the final quarter since the market now believes we will only have two rate cuts in 2025. The Barclays Aggregate Bond index dropped 3.06% in the final quarter. Global bonds rose 6.22% on the year.

Economic Review and Outlook

Economic growth was steady all year primarily due to consumer spending. Third-quarter GDP came in at an annualized rate of 3.1%. Household debt has risen back to 11.3% of disposable personal income. We are getting closer to pre-COVID levels. Indications are that the fourth-quarter GDP number will be in the 3% range capping off a solid 2024. We do expect 2025 growth to slow, due to strains on consumers.

The Federal Reserve cut the Fed Funds Rate by 25 basis points in December. Inflation is hovering around 2.7% annually, which is close to the Fed’s target of 2.0%. The market expects the Federal Reserve to make two cuts in 2025 instead of four. If trade tariffs are implemented, this could spur additional inflation which would limit any further rate cuts by the Fed.

The Leading Economic Index increased 0.3% in November to 99.7 following a 0.4% decline in October. Industrial Production dropped 0.1% in November. The Capacity Utilization rate (which measures how much slack is in the economy) moved up to 76.8% which is now 2.9 percentage points below its long-term average.

Non-farm payrolls rose by 227,000 in November and the unemployment rate remains at 4.2%. Weekly unemployment claims were 201,000 for the week ending January 4, 2025. The 4-week moving average is at 213,000. There are 7.7 million job openings in the U.S. which is down from 10.1 million in June. It is important to remember that the unemployment rate is a lagging indicator. The unemployment rate is now 0.7 percentage points higher than the low of 3.4 last year. We have never seen an increase of 0.6 or more and not been in a recession. We could see more weakness in the labor market in 2025.

Manufacturing registered 49.3% on the ISM PMI index in December. This was much higher than November, but it has been in contraction territory for 25 out of the last 26 months. The New Orders Index came in at 52.5% which was 2.1 percentage points higher than November and represents good expansion. The ISM Services index was at 54.1% in December which was 2 percentage points higher than November. The Business Activity Index came in at 58.2% which was 4.5 percentage points higher than the prior month. New Orders for the service sector came in at 54.2% which was 0.5 percentage points higher. The Employment index was at 51.4% and has been in expansion territory for the fifth time in six months.

The JPM Global Manufacturing PMI was at 49.6 in December. This was down from a reading of 50.0 in November and is now in contraction territory. The Euro area is at 49.5 while Emerging Economies are growing at 52.8 led by India at 60.7 and Brazil at 55.1.

Equity and Bond Markets

Equity markets had some bumps in the fourth quarter but still managed to produce strong results for the calendar year. For the second year in a row, domestic large-cap stocks were the best performing asset class. This was followed by mid-cap stocks and finally small-cap stocks. International equity returns were strong locally, but the rising dollar hurt the final return for U.S. investors. For example, The EAFE index is showing a return of around 4% for U.S. investors, but in local currencies, it was actually up nearly 12%. Emerging markets provided U.S. investors with a return of 8% but in local currencies, it was closer to 14%.

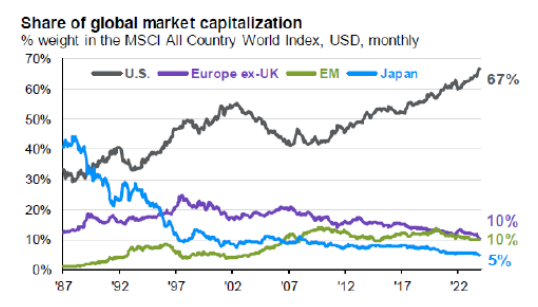

Going back to 1987, Japan’s stock market was the largest in the world and represented more than 40% of the global market capitalization. The U.S. was second with a weighting around 30%. Fast-forward to today, Japan’s market cap weighting is down to 5% while the U.S. has soared to 67%. The United States currently produces about 26% of the world’s Gross Domestic Product and yet our market weighting is 67%. Meanwhile, Emerging Economies are producing 41% of global GDP yet their market cap weighting is only 10%.

From a valuation perspective, U.S. large-cap growth stocks are expensive. The top ten stocks in the S&P 500 carry a P/E ratio of 30 times earnings versus their long-term average of 20 times earnings. The remaining stocks in the S&P 500 have a P/E ratio of only 18 times earnings. This is telling us that smaller companies and value companies are attractive at these price levels. International stocks have struggled since 2009 as you can see from the chart above. We think it is reasonable to see a convergence in the global market cap weighting over the next five years. It will be important to maintain exposure to stocks outside of the U.S.

The elections in November are having an impact on not only the equity markets, but also the bond markets. The market now believes that the Federal Reserve will only cut rates twice in 2025 and will then pause. The reason for this shift is the potential impact of higher trade tariffs. While higher tariffs might be good in the long run for the U.S. economy, it could spur inflation in the near-term. Higher tariffs essentially will get passed on to the consumer and the price of goods will increase. Since 70% of our economy is based on consumer spending, reigniting inflation for consumers could result in slower economic growth over the next couple of years. Therefore, bond prices have retreated recently as the prospect of lower yields has diminished.

Portfolio Management

The Investment Committee continues to monitor the economy, the market, and the portfolio allocations. The economy is still growing as consumers are continuing to spend. It looks like GDP in Q4 will again be in the 3% range. We think economic growth will slow in 2025, but we don’t see a major recession just yet. We do typically get one 10% market correction each year and three 5% corrections. So, expect continued volatility in 2025.

We have been primarily sticking with our overall allocation. While U.S. large-cap growth stocks are expensive, they can remain that way for a while. It will be important to stay diversified both domestically and abroad as we could see performance shift as this cycle matures.

The fixed income side of our portfolios has been a challenge. It is pretty rare that cash outperforms bonds, but that was the case in 2024. Even if we only get two rate cuts this year, bonds should continue to provide income, capital preservation, and even price appreciation. We will continue to monitor the economic and political landscape, to make sure that we are properly positioned and diversified.

Any changes that we do make will be tactical in nature as we will not try to “time the market.” We are long-term investors and will do our best to ignore the short-term volatility we could see over the next six months.

Financial Planning

A mega backdoor Roth 401(k) is a fairly new retirement funding strategy that has become more popular in the last year. The mega backdoor Roth 401(k) is similar to a backdoor Roth IRA strategy but with added complexity.

First and foremost, this strategy only works inside an employer 401(k) plan. The 401(k) must allow the strategy and not all plans do. If you are interested in this strategy, we recommend reaching out to your HR department to ensure your 401(k) plan qualifies.

There are several ways employees can contribute funds into a 401(k). They each have different tax ramifications:

- Pre-tax Contributions – Reduce an employee’s taxable income today. When funds are withdrawn from the 401(k) in retirement, ordinary income taxes are paid on the amount withdrawn.

- Roth Contributions – Do not reduce an employee’s taxable income today. All funds withdrawn in retirement are not subject to taxes.

- After-tax Contributions – Do not reduce an employee’s taxable income today. When funds are withdrawn in retirement, no taxes are due on the contribution amount, but any earnings on after-tax funds are subject to ordinary income tax rates.

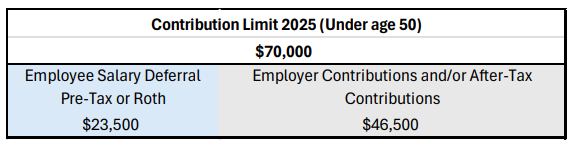

Individuals are limited on how much they can invest annually into a 401(k). In 2025, the maximum amount is $70,000. If you are age 50-59 or 64+, you can contribute an additional $7,500 as a catch-up contribution. If you are age 60-63, you can contribute an additional $11,250 as a catch-up contribution. The maximum dollar amount includes all employee contributions and employer contributions.

There are a few sources of funds that can make up that $70,000 limit. The first is employee salary deferrals with either pre-tax or Roth funds. That limit is $23,500 in 2025. The next most common type is employer contributions: this could be a match, a profit-sharing contribution, and/or a safe-harbor contribution. Finally, after-tax employee funds can be contributed. Below is a chart to illustrate:

To complete a mega backdoor Roth, you must first fully fund your employee salary deferral of $23,500. Once that bucket is fully utilized, you can elect for after-tax funds to be invested in your 401(k). These after-tax funds are then either:

- Converted within your 401(k) to the Roth 401(k) side. This is called an in-plan Roth conversion.

- Rolled into a Roth IRA. This requires your 401(k) to allow in-service withdrawals.

Let’s walk through an example: an individual age 45 is fully maximizing their 401(k) with Roth deferrals of $23,500. Their employer is contributing $10,000 through a salary match and profit-sharing. This leaves $36,500 available to contribute before hitting the $70,000 limit.

$70,000 limit – $23,500 employee deferral – $10,000 employer contributions = $36,500

The individual chooses to contribute $36,500 as an after-tax contribution. This $36,500 is converted to the Roth 401(k) using an in-plan Roth conversion.

Mega backdoor Roth 401(k)s do not make sense for every individual. It is a complex strategy with a lot of moving variables. Be sure to reach out to your Fee-Only advisor with questions on the strategy.

Company News

Our office construction has continued into 2025. We are nearing the end of the project and hope to have all the final dust and debris cleared out in another few weeks. Here is a sneak peak of our new space! We will be sharing more of our renovation on our social media channels, so be sure to follow along on Facebook and LinkedIn.

In more exciting news, the 4th quarter of 2024 brought us a new member of the Galecki family. Andy Young and his wife Mollee welcomed daughter Kennedy into the world.

Congratulations to the Young family!