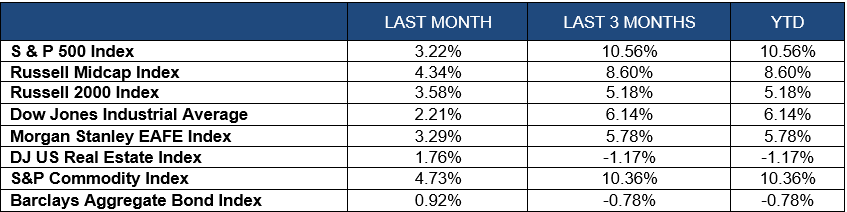

Index Returns

Equities had a strong finish in the last quarter of 2023 and continued their rally in the first three months of this year. The S&P 500 was up another 10% in the first quarter. Large-Cap growth stocks were up more than 12% while Large-Cap value stocks were up about 8%. Mid-cap stocks and small-cap stocks had decent returns with gains of 8.6% and 5.1% respectively.

Developed International stocks continue to move higher with a gain of 5.78% according to the EAFE Index. Italy and Japan were up 12% and 11% in the first quarter. Emerging markets continue to be mixed. Brazil, China and Chile all declined while India advanced 6%. Commodities had a good quarter with the S&P Commodity index advancing 10%. Silver Miners were up roughly 23% in March alone.

Bonds reversed course in the first quarter as rate cut expectations softened. The Barclays Aggregate Bond index dropped 0.78% in the first quarter. Global bonds however rallied 1.82% over the first three months.

Economic Review and Outlook

Economic growth in 2023 was stronger than expected. In fact, the fourth quarter GDP came in at 3.4%, much higher than anticipated. What is causing this growth and strength in the economy? There are a number of factors for this but one is clearly job growth. We have been adding roughly 265,000 jobs per month over the last three months. Most of this job growth is coming from foreign born workers. While there are potential long-term complications with this type of growth, we are nonetheless getting additional workers who are adding to the labor force and helping overall consumer spending.

Inflation is relatively under control. Right now, we are hovering around 3.2%. The cost of shelter continues to be the biggest reason that the number is not lower. However, this is a lagging indicator and will continue to decline over time. The other big contributor to the inflation data has been auto insurance. This will also subside over the next six months. Therefore, we think the inflation data will slowly improve over the remainder of the year.

The Leading Economic Index declined 0.1% in December to 103.1 following a 0.5% decline in November. Industrial Production increased 0.1% in February. The Capacity Utilization rate (which measures how much slack is in the economy) moved up to 78.3% which is in line with it’s long-term average.

Non-farm payrolls rose by 303,000 in March and the unemployment rate remained at 3.8%. Weekly unemployment claims were 221,000 for the week ending March 30, 2024. The 4-week moving average is at 214,250. There are 8.8 million job openings in the U.S. which is down from 10.1 million in July. Job layoffs have remained stable while the number of individuals quitting their jobs has dropped. It is important to remember that the unemployment rate is a lagging indicator. Top leading indicators would be the yield curve, durable goods orders, the stock market, manufacturing orders, and building permits.

Manufacturing registered 50.3% on the ISM PMI index in March. This was an increase of 2.5 percentage points from February and stopped the 16-month streak of contraction territory for this index. The New Orders Index came in at 51.4% which was 2.2 percentage points higher than February. The ISM Services index was at 51.4% in March and marks the 15th consecutive month of expansion. The Business Activity Index came in at 57.4% which was a 0.2 percentage point increase from February. New Orders for the service sector came in at 54.4%, but this was a drop of 1.4 percentage points from the prior month.

The JPM Global Manufacturing PMI was at 51.6 in March down slightly from the 52.1 mark in February. The Euro area is at 47.9 while Emerging Economies are growing at 53.4.

Equity and Bond Markets

Equity markets have continued their push higher with domestic large-cap growth stocks leading the way. The top ten stocks in the S&P 500 now make up 33.5% of the market cap weighting and are carrying a P/E ratio of more than 28 times earnings. The other 490 stocks have a P/E ratio of 18 times earnings. Value stocks have historically outperformed in higher interest rate environments, so it will be important to keep an appropriate allocation to value-oriented companies.

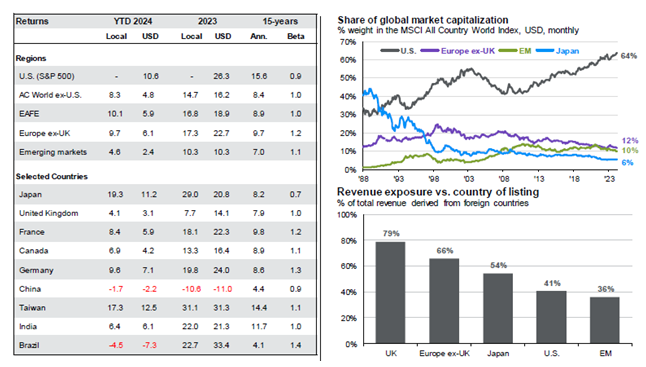

Diversification may be an important theme in 2024 if the mega cap growth stocks begin to falter. One key to diversification is to own companies outside of the U.S. Back in the late 1980’s, Japan’s market cap was the largest in the world at more than 40%. Today, the market cap of the U.S. market now represents 64% of the global market. This is an all-time high for U.S. stocks while Japan is down to 6%, emerging markets are at 10% and Europe ex-UK is at 12%. Maintaining exposure to international markets can help your portfolio during periods of domestic corrections.

The bond market is expecting three rate cuts later this year. This is in line with what the Federal Reserve has been forecasting. If this does occur, existing bonds should do quite well over the next 18 months. Cash is offering attractive yields but be careful not to over-allocate to this asset class.

The Investment Committee continues to monitor the economy, the market, and the allocations. The economy continues to grow at an impressive pace. While GDP may not be as robust in 2024, we still see expansion in the near-term. The market has gotten expensive in a few areas. Artificial Intelligence is fueling earnings growth for many companies. The expectation in the market is that this should continue and warrants higher multiples.

We are maintaining our overall allocation and have made some minor changes within the broad asset classes. We believe that value stocks will begin to outperform growth stocks over the next few years. We also think that international equities should provide a boost to the portfolio, especially if the U.S. Dollar begins to decline, which we think is likely.

It is important to keep a long-term focus and ignore short-term volatility. This is a presidential election year, and we could see some volatility heading into the summer. Once we get past the election and remove that uncertainty, we should start to see volatility subside.

Financial Planning

We are confident that nearly everyone reading this has at some point received a notice that their personal information has been hacked or stolen. When confronted with the reality that our Social Security Numbers, Dates of Birth, and even health records have been compromised, it can stir up a mix of fearful emotions. There are many services on the market today that are designed to help individuals protect against their personal information being used by someone else. Usually, the at fault organization provides one year of free credit monitoring to all impacted individuals. In the case of protecting credit, one of the best services is one that has been around for years: a credit freeze.

There are three main credit bureaus in the United States: Experian, Transunion, and Equifax. When applying for a new mortgage, loan, or credit card, the lender checks your credit with one, or all three of these bureaus. Your credit history determines if you will be approved for the loan and the interest rate you will be charged.

A credit freeze locks your credit report with each agency. When your credit report is locked, your credit history cannot be accessed. This means that no new credit lines can be opened using your personal information. Locking your credit report does not impact any existing loans or credit cards. If you need to apply for new credit, you must temporarily lift the freeze with the credit agency.

Traditional credit monitoring does exactly what it says; it monitors your credit, but does not lock it like a freeze. The credit monitoring service will alert you if someone has accessed your credit, but it does not prevent it. Individuals must usually pay for credit monitoring services compared to a credit freeze, which is free.

The process of placing and lifting a credit freeze has changed many times over the years. The fastest and easiest way to place and lift a freeze is by creating online accounts at each credit bureau.

Experian, Transunion, and Equifax all have slightly different websites, but the overall process is the same. To place a freeze, you input your information to create an online account. Each website will verify your identity by asking questions specific to your credit history. These questions can be about your previous addresses, credit cards you have opened, and monthly payments on existing loans. The websites will also require two-factor authentication with a code sent to your cell phone number or email address. Creating an account at each bureau can take 10-20 minutes. If you need to lift your freeze in the future, you log back into that same website to request a temporary lift.

It is extremely important to keep the login information for Experian, Transunion, and Equifax securely stored.

Below are the websites for each credit bureau if you would like to place or manage a freeze on your credit.

Experian – https://www.experian.com/freeze/center.html

Transunion – https://www.transunion.com/credit-freeze

Equifax – https://www.equifax.com/personal/credit-report-services/credit-freeze/

Company News

Galecki Financial Management is pleased to announce two new members of our team: Jeran Lantz-Robbins and Audrey Morken. Jeran and Audrey both started in December and have already begun making their marks on our firm.

Jeran is our Asset Management Specialist. He works with all our advisors to optimize the company’s financial systems on the back-end and collaborates closely with the team to streamline processes, mitigate risks, and ensure clients receive the highest level of service.

Jeran is our Asset Management Specialist. He works with all our advisors to optimize the company’s financial systems on the back-end and collaborates closely with the team to streamline processes, mitigate risks, and ensure clients receive the highest level of service.

He brings a wealth of experience from diverse industries including financial services, real estate, and business process outsourcing. In addition, Jeran is a veteran and currently serves in the Army Reserves.

When not working, Jeran is most happy spending time with his wife Emma and daughter Mya. Some of their hobbies include hiking, camping, and spending time at the family lake house. When not outside he enjoys reading, playing chess, and movie nights.

Audrey is a Staff Financial Planner, who works directly with Melanie Colwell on her client relationships. Audrey and Melanie work as a team to ensure that all clients’ financial needs are being met.

Audrey is a Staff Financial Planner, who works directly with Melanie Colwell on her client relationships. Audrey and Melanie work as a team to ensure that all clients’ financial needs are being met.

Audrey graduated from Indiana Tech in 2020 with a Bachelor’s Degree in Business Administration with a concentration in Human Resources. She previously worked as a branch manager at a community bank.

Outside of the office, Audrey devotes her time to her family. She is married and has two toddlers that keep her and her husband busy. Audrey supports Big Brothers Big Sisters of Northeast Indiana and the Alzheimer’s Association. She enjoys all types of games (video, board, trivia), reading books, music, cooking and spending time with friends and family.